Need to reallocate but don’t want to pay capital gains tax? Read this.

Many people, including some of our clients, have been the “victim” of the paradigm where they need to sell highly appreciated stocks and ETFs but don’t want to trigger capital gains tax right now (or ever if done correctly).

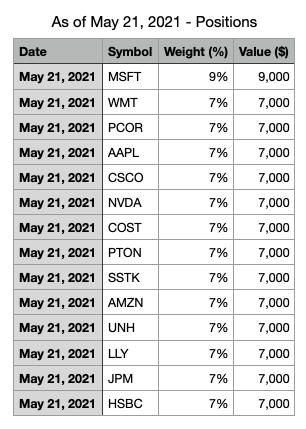

To give an example, I created a fictitious portfolio of: 7% Apple (AAPL), Cisco Systems (CSCO), Nvidia (NVDA), Costo (COST), Walmart (WMT), Procore technologies (PCOR), Peloton (PTON), Shutterstock (SSTK…which is getting acquired by Getty Images (GETY)), Amazon (AMZN), United Healthcare (UNH), Eli Lilly (LLY), J.P. Morgan Chase & Co (JPM), HSBC Holdings (HSBC), and 9% in Microsoft (MSFT). The number of positions was not evenly divisible and I choose MSFT at random for the overweight. The starting date of May 21, 2021 was chosen as that was the day after PCOR went public, and thus was the earliest common inclusion date.

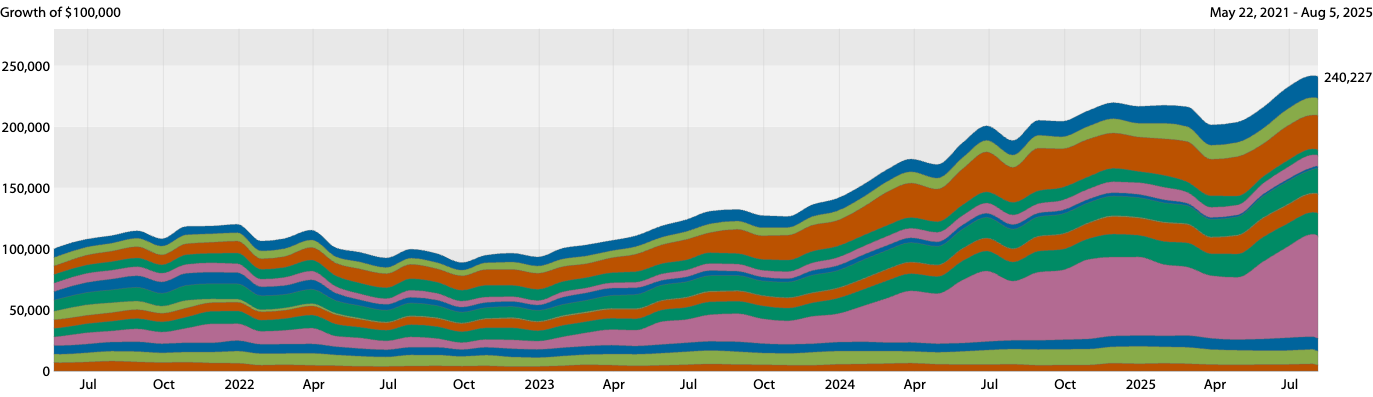

As you can probably guess, this portfolio smokes the S&P 500 index, despite having a few really bad stocks. Their lack of price performance will further exacerbate the issue of concentrated returns as it creates a larger spread between the winners and the loosers.

Here are the change in weights over time. Some are drastic. Ironically, only PTON, SSTK, PCOR, and UNH logged net losses in this scenario. As you can see, this causes most of the single stock gains to be held in NVDA. So how would you re-diversify? Oh, let’s not forget Uncle Sam always has his hand out for capital gains tax.

I think we can all guess which one is Nvidia.

First, let’s talk about why you would want to rebalance or re-diversity. It’s pretty simple, instead of being diversified across fourteen different investments, you end up concentrated in NVDA and LLY; making you at the mercy of those two stock movements for 45% of your portfolio. The real impact of this is your portfolio volatility goes up.

While volatility was similar for both portfolios at times, from April 2024 and onward, you can really see the additional volatility.

Let’s face it…you’ve done well (really well), you don’t want to trigger capital gains if that’s possible, but you want or need to rediversify to a new portfolio given market changes. You probably really want to get rid of your PTON and UNH stock by now, in reality we would have sold them the trigger capital losses.

Not to worry, Section 351 exchanges are here to help… I know, it’s hard to get excited when someone brings up the tax code as a hero…

What is section 351?

Section 351(a) states

“that No gain or loss shall be recognized if property is transferred to a corporation by one or more persons solely in exchange for stock in such corporation and immediately after the exchange such person or persons are in control (as defined in section 368(c)) of the corporation.”

Historically, what this meant is people starting a business could give property to the business in lieu of cash and not have a taxable event associated with the transfer. Today, we use the same principle to contribute financial assets. Think of it as a stock potluck. You contribute stocks to the ETF and once the formation and seeding is complete, you receive ETF shares in return. This does not reset your cost basis; you still have the cost basis of the stock you contributed, but you did not realize capital gains while diversifying away from your concentrated stock risk..

What’s the catch?

You can’t contribute all one position, not even close. In fact, no single position can be more than 25% (known as the 25% rule), and not more than 50% of the value can be in five or fewer issuers (known as the 50% rule). These two create the 25/50 diversification tests that makes sure you are not trying to go from a fully concentrated portfolio to a diversified one without paying capital gains. Additionally, the securities you want to contribute to the seed round have to be exchange-traded (no mutual funds). The other major catch is that this had to be done when seeding a new ETF, it cannot be done on an on-going basis. If you fail to meet the diversification tests set out in IRC Section 368(a)(2)(f), it will be treated as a taxable event.

How do I get around it?

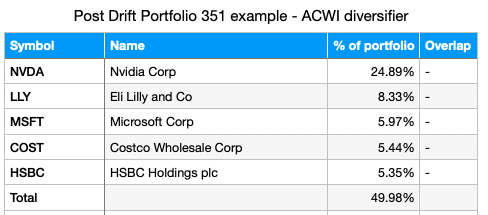

The portfolio above would not be able to have the entire portfolio seeded in the 351 exchange due to the 34% in NVDA. If we wanted to do a 351 exchange for the entire portfolio above, we could buy additional stocks or a diversified ETF. Buying a diversified ETF would be the easiest way. How much more you would need to buy is determined by the weights of the underlying ETF. This is because ETFs are looked at on a “look through” basis, if you were to buy the SPDR® S&P 500® ETF (SPY), it would be looked at as having 500 positions, not just one. For example, we would need to buy an additional $135,000 of the SPY to have NVDA account for 25% of the overall allocation, and it would only get us around the first concentration rule. This is because, as of this writing, NVDA is a 7.34% weight of SPY. If we were to buy a different diversified ETF, without as much NVDA as an underlying holding, we would have to buy less of it. If we bought the iShares MSCI ACWI ex US ETF (ACWX), which holds no NVDA exposure, then we could get away with buying $93,500 to meet the 25% rule. Alternatively, you could go pick a handful of other stocks and add to your positions you already have or buy other stocks you don’t currently own.

What about the 50% rule? The rule that says you cannot have the top five contributed positions account for more than 50% of the contributed property is also defeated by using the diversified ETF and the look-through treatment. Even if we bought $93,500 the ACWI, the top five positions come out to be 50.21%. Only when we buy $95,000 of ACWI would be meet the two diversification rules as NVDA would be 24.98% and the top five positions contributed would be 49.98%.

In carrying on with our example, our cost basis in the portfolio is $100,000 for our initial buy in + $93,500 ETF buy to pass the diversification tests + $7,043 of reinvested dividends = $200,543. Our total portfolio value would be $333,727. This leaves (or would leave) $133,184 subject to capital gains tax, mostly long term, but some short term on the shares acquired via dividend reinvestment if you were to just sell everything. But, with the 351 exchange to an ETF, you would theoretically (if all asset prices hold) be able to contribute the portfolio in exchange for shares of the new ETF.

While the 351 exchange does not eliminate the capital gains taxes, it can allow you to diversify again without triggering them.

Bear in mind, this is not all encompassing and we deliberately did not give you all of the nitty-gritty details to spare you the reading.

Keep in mind, this is not tax advice or a recommendation to take any action or inaction on any security mentioned. Get tax advice from your CPA or tax adviser.

Author: William Nunn, CFP® Financial Planner, Founder of Horizon Financial Planning LLC