Understanding Restricted Stock Units

RSUs are relatively simple compared to other types of equity compensation, let’s take a look.

Spoiler Alert: The tax reporting is fairly straightforward.

As a financial planner, I often meet with employees who are excited about their new job’s equity compensation but uncertain about how RSUs actually work. If you’ve recently received an RSU grant, this guide will help you understand the basics and make informed decisions about your equity compensation.

What Are Restricted Stock Units?

Restricted Stock Units represent your company’s promise to transfer actual shares of stock to you at a future date, provided you meet specific conditions. Think of RSUs as “bait” for you to stay with the company. It’s company stock that is placed in your account but only becomes “real” or controllable/sellable shares only after you’ve satisfied the requirements—typically remaining employed for a certain period. This is called vesting.

Key differences from stock options:

• RSUs cost you nothing upfront

• No purchase required—you receive shares directly

• Cannot access, sell, or transfer until they vest

• Exist only on paper during restriction period

Understanding Vesting Schedules

Vesting schedules determine when your RSUs convert to actual shares you own outright. Companies design these schedules as retention tools, encouraging employees to remain with the organization.

Graduated Time-Based Vesting

• Most common structure: Annual vesting over multiple years

• Example: 25% annually over four years

• Timeline: One-quarter of total grant on each anniversary

Cliff-Style Vesting

• Structure: No initial vesting, then large portion vests simultaneously

• Example: Nothing for 12 months, then 25% all at once

• Purpose: Ensures minimum employment period

Milestone-Based Vesting

• Common in Pre-IPO companies

• Triggers: Company going public, revenue targets, acquisition

• Risk: Uncertain timing and achievement

Tax Implications: The Two-Event System

RSU taxation involves two distinct taxable events that occur at different times:

First Tax Event: Vesting

When it happens: RSUs convert to actual shares

Tax treatment:

• Fair market value treated as ordinary compensation income

• Added to your W-2 income

• Subject to all standard payroll taxes:

• Federal income tax

• State income tax (where applicable)

• Social Security tax

• Medicare tax

Important: Stock’s closing price on vesting date = your “cost basis”

Second Tax Event: Sale

When it happens: You sell your vested shares

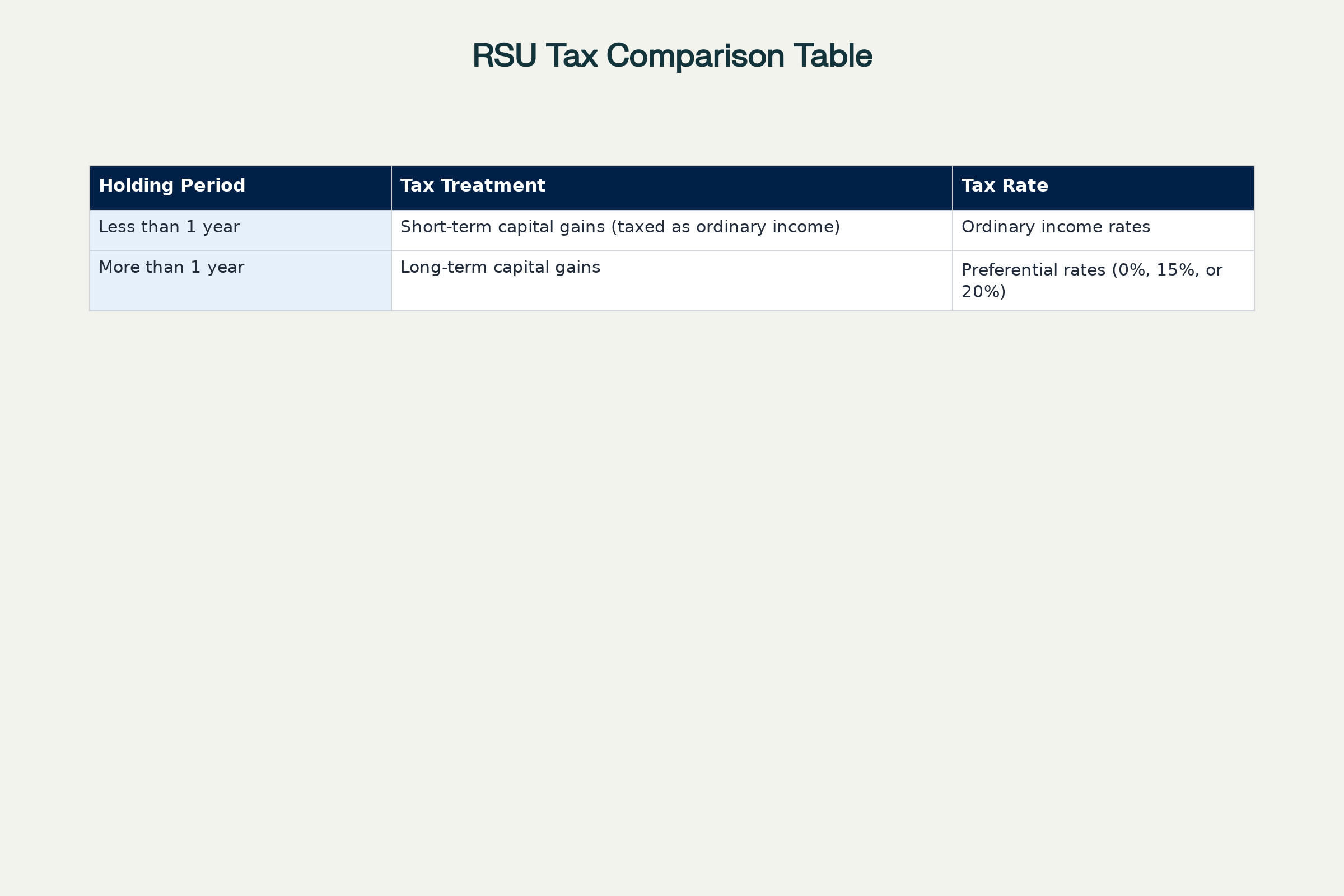

Tax treatment depends on holding period: Capital gain or ordinary income treatment will depend on how long you have help the stock after vesting.

Practical Example: Michael’s RSU Experience

Let me illustrate with an original scenario based on situations I’ve encountered in my practice:

Michael’s Grant Details

• Total RSUs granted: 320 units

• Vesting schedule: 80 units annually over four years

• Company: Publicly traded technology firm

Year One Vesting Event

• Date: March 15, 2024

• Stock price at vesting: $75 per share

• RSUs vesting: 80 units

• Taxable income: $6,000 (80 × $75)

Tax withholding process:

• Combined tax rate: ~30%

• Tax obligation: $1,800

• Shares sold for taxes: 24 shares

• Shares Michael keeps: 56 shares

Later Sale Decision

Timeline: 18 months after vesting Sale details:

• Sale price: $90 per share

• Total proceeds: $5,040 (56 × $90)

Tax calculation:

• Original cost basis: $75 per share

• Capital gain per share: $15 ($90 - $75)

• Total long-term capital gain: $840 (56 × $15)

Result: $840 gain taxed at long-term capital gains rate (~15%) instead of ordinary income rate

Strategic Considerations for RSU Recipients

Immediate Sale Strategy

Advantages:

• ✅ Portfolio diversification

• ✅ Eliminates company-specific risk

• ✅ Provides immediate liquidity

• ✅ No additional market risk

Why this matters: Concentration risk—if your company struggles, both your job and investments suffer.

Tax Management Approaches

During heavy vesting years:

• Increase 401(k) contributions to offset higher income

• Consider quarterly estimated tax payments

• Review overall tax bracket implications

• Plan for additional tax burden

Hold-and-Sell Timing

Reasons to hold (more than 1 year):

• Strong belief in company prospects

• Access to long-term capital gains rates

• Potential for additional appreciation

Important reminder: Investment decisions should align with your overall financial plan, not just tax considerations.

Overall, RSUs can be used as an effective employee retention tool and reward employees handsomely if the company’s stock price does well. We know it can cause some confusion and frustration, especially if your employer does not reduce your number of shares to withhold taxes. The tax impact of RSUs can pile up if you were awarded multiple grants year after year. Overconcentration and making sure you don’t get a tax bill you can’t handle are the two things we help clients with the most on RSUs.